8414 Farm Road Ste 180 -1058

Las Vegas, NV 89131

(877) 272-7069

About Us

ASAP Financial Solutions LLC

Kandy Dugá, the owner ofASAP Financial Solutions LLC, is a Board Certified Credit Consultant specializing in Credit Repair and Credit Building.

Kandy seeks to change lives by helping good people that have had bad economic situations negatively affect their credit. Kandy's ability to relate to credit and financial issues, as well as her knowledge and understanding the credit laws, are the key to her success. Kandy's commitment is to help you get your credit restored in as little as 60 days.

"It is my goal and my passion to help people obtain a fresh start at having good credit and achieve their financial goals and dreams through professional guidance teamed with integrity, honesty, and ethical service."

You will find that Kandy is compassionate, honest, inspirational, confidential, knowledgeable, and most importantly - she is excited to help get you on your way to good credit.

The first step towards a better financial future is the most important, but it can also be the toughest. You have to first decide that you want to make major changes in your life - to save more, be disciplined with your spending, and develop the dedication and commitment to see those choices come to real fruition.

Once you understand how valuable having good credit is, we will take care of the rest!

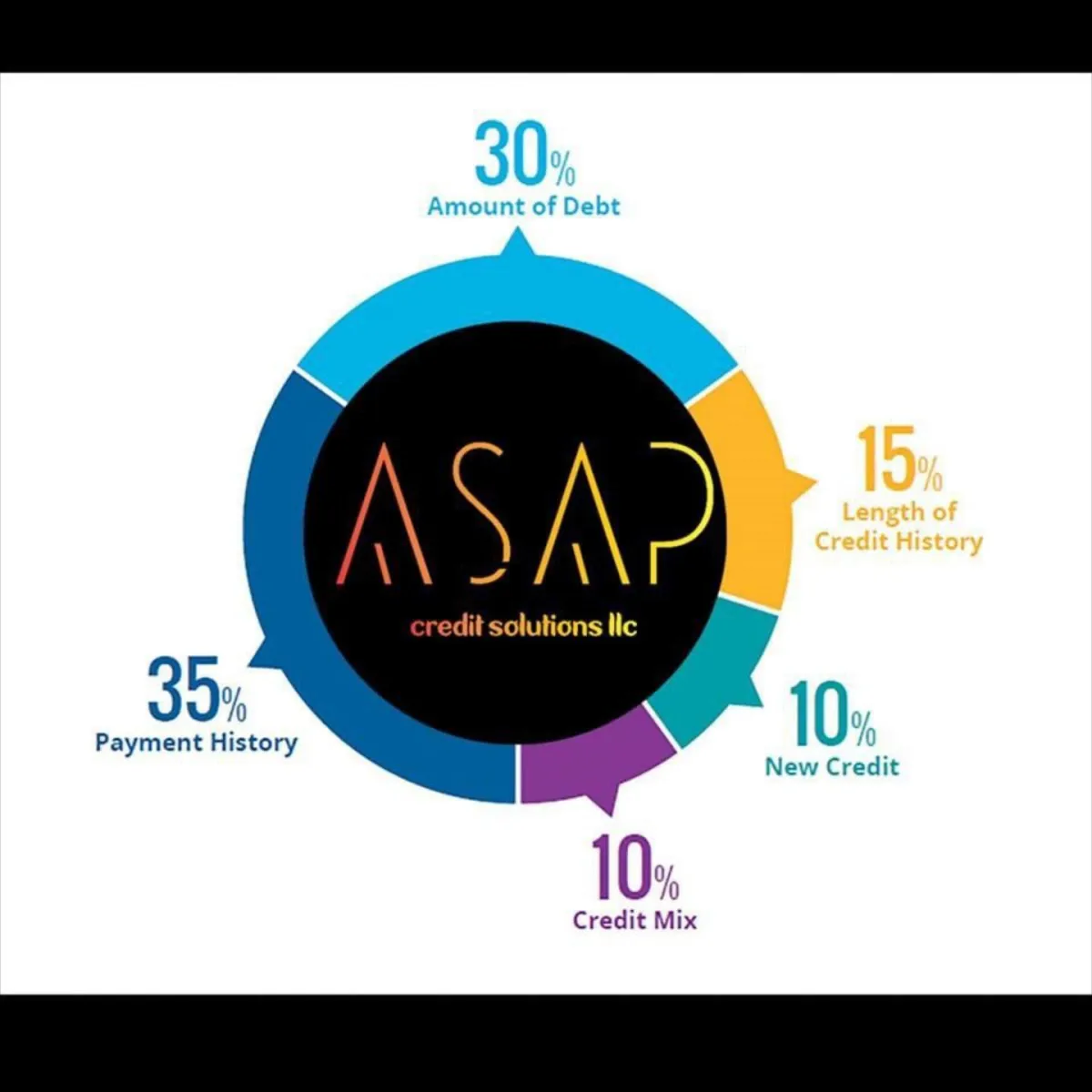

1. Payment History

Your payment history is generally the most important factor in calculating your credit score because it shows lenders whether you’ve been reliable in making consistent on-time payments – an indicator that you’re likely to pay back your debts in the future. For this reason, just one or two late payments could significantly hurt your credit score.

2. Credit Card Utilization

Credit utilization ratio – also known as debt-to-limit ratio – measures the amount of your overall credit card limit that you are using. A good rule of thumb is to keep your credit utilization ratio below 30%2, but the lower the better. A high credit utilization ratio can lower your credit score and may make potential lenders worry that you’re overextended and may not be able to handle more debt. Your credit card utilization ratio is calculated by dividing your total outstanding balances on all of your cards by your total credit limit.

3. Age of Credit & Established Credit History

Establishing a long credit history usually improves your credit score as long as you have a history of consistent on-time payments on your open accounts. Factors that feed into this element of your credit score include how long all of your credit accounts have been open (the age of your oldest account, the age of your newest account, and an average age of all your accounts), how long specific credit accounts have been open, and how long it has been since you used each account.

4. Credit Mix and Number of Accounts in Use

The number and the mix of credit accounts that you have in use – credit cards, auto and student loans, mortgages, and other lines of credit – all contribute to your credit score. In general, having more open credit accounts leads to a better credit score. Why? Having more accounts means you’ve been approved for credit by more lenders. In addition to your number of open accounts, having a diverse mix of credit across the two main categories – revolving credit and installment loans – may also improve your credit score:

Revolving Credit: credit products such as a credit card or a home equity lines of credit (HELOCs), in which you make a different payment each month depending on how much you spend (or how much of your credit you use)Installment Loans: loans with fixed ratesand fixed payments of equal amount made over a fixed timeline

5. Hard Credit Inquiries and New Credit

Each time someone pulls your credit report — a lender, landlord, or insurer – an inquiry is documented on your credit report. Keep in mind that there are two types of credit inquiry – hard and soft inquiries – and only hard inquiries are visible to others on your credit report and impact your credit score.

ASAP Financial Solutions LLC

8414 Farm Road Ste 180 -1058 | Las Vegas, NV 89131 | (877) 272-7069

© 2011 - 2023 ASAP Financial Solutions LLC